|

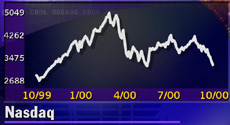

Nasdaq flirts with 2000 low

|

|

October 11, 2000: 5:25 p.m. ET

Bad news from Yahoo!, Lucent, Motorola are the latest tech-selling catalysts

|

NEW YORK (CNNfn) - The Nasdaq composite index came within four points of its lowest close of the year Wednesday, falling for a fifth straight session on a big slide in Yahoo!, the latest company to disappoint Wall Street with its financial outlook.

|

|

VIDEO

|

|

Birthday wishes to Bull Market!, CNNfn's Peter Viles reports from New York.

Birthday wishes to Bull Market!, CNNfn's Peter Viles reports from New York.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Two other technology bellwethers, Lucent Technologies and Motorola, warned about earnings shortfalls, hitting a skittish market that has fallen every week since the end of August.

"Right now there's a lot of fear," Ryan Jacob, chairman of Jacob Asset Management, told CNN's Street Sweep.

Faced with steep losses since Labor Day, stocks investors have sought to determine if the worst is over for a market that historically has always bounced back. After opening sharply lower, the Nasdaq broke into positive territory by mid-afternoon, only to fall by session's end.

Tom Giles, senior equity strategist at Dean Investment Associates, says the bottom is near for the Nasdaq, which has tumbled more than 21 percent in 2000. Tom Giles, senior equity strategist at Dean Investment Associates, says the bottom is near for the Nasdaq, which has tumbled more than 21 percent in 2000.

"The fourth quarter is usually a good time for technology," Giles told CNNfn's Talking Stocks.

The Dow Jones industrial average, which has held up better than the Nasdaq this year, continued that trend. The 30-stock index, less weighted with tech stocks, fell about half as much as the Nasdaq Wednesday.

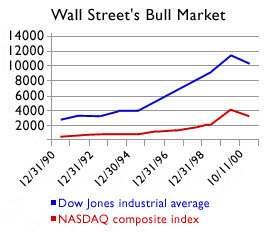

But long-term investors may not care. By many estimates, the bull market began 10 years ago this week when the Dow bottomed at 2,365.10. The Dow has more than quadrupled since then, while the Nasdaq has jumped nearly tenfold, creating trillions of dollars in wealth.

The Nasdaq shed 72.05 points, or 2.2 percent, to 3,168.49 after falling as low as 3,103.53 earlier Wednesday. The latest stumble puts the index just four points above its lowest close of the year: 3,164.55, set May 23.

The Dow fell 110.61 points, or 1 percent, to 10,413.79 and is down 9 percent on the year. The S&P 500 shed 21.35, or 1.5 percent, to 1,364.59, pushing it 7 percent lower for 2000.

Still, investors found places to hide, buying up consumer stocks, oil shares and Treasury securities, which have outperformed stocks this year. Still, investors found places to hide, buying up consumer stocks, oil shares and Treasury securities, which have outperformed stocks this year.

More stocks fell than rose in heavy trading. Declining issues on the New York Stock Exchange topped advancing ones 1,985 to 898, on trading volume of 1.3 billion shares. Nasdaq losers beat winners 2,789 to 1,235, as more than 2.3 billion shares changed hands.

In other markets, the dollar rose against the euro and yen.

Latest tech wreck

One of Nasdaq' biggest losers, Yahoo! (YHOO: Research, Estimates) fell $17.31, or 16 percent, to $65.38 after reporting third-quarter earnings of $81.1 million, or 13 cents per diluted share. The figures, though more than double the year-ago profit, were still only 1 cent a share ahead of forecasts.

The results come at a time when investors are selling on any imperfections.

"Right now investors are looking at any earnings reports as the glass half-empty rather than half-full," Ryan Jacob said.

And the Internet portal's total number of advertisers declined from the second quarter. And the Internet portal's total number of advertisers declined from the second quarter.

"The long-term growth rate of Yahoo is not as good as some people thought," Scott Reamer, analyst at SG Cowen, told CNNfn's Market Call.

In its third profit warning this year, Lucent Technologies (LU: Research, Estimates) said late Tuesday it expects earnings for its fiscal fourth quarter to fall short of analysts' estimates. A series of brokerage downgrades followed.

Lucent stock, which has declined more than 50 percent this year, fell $10.13, or 32 percent, to $21.25.

Motorola's (MOT: Research, Estimates) results didn't help. The telecommunications equipment maker late Tuesday met its earnings expectations while its revenue missed some forecasts. And Wednesday, in a conference call, Motorola said it expects to earn 27 cents a share in the fourth quarter, well short of the First Call consensus estimate of 37 cents a share.

Motorola lost $4.81, or 18 percent, to $21.44.

Still, investors moved back into some of technology's former leaders. Microsoft (MSFT: Research, Estimates) rose $1.19 to $55.75, while Cisco Systems (CSCO: Research, Estimates) advanced 6 cents to $51.19.

More news from CNNfn.com for investors:

· Take it one stock at a time

· Special Report: Eyes on the Market

· Poll: Nasdaq's blues

Stocks have fallen since the September amid a blitz of profit shortfall announcements. Among the biggest, bellwethers such as Intel (INTC: Research, Estimates) and Apple Computer (AAPL: Research, Estimates) prepared Wall Street for disappointing results this fall and have seen their market values slashed.

With the losses, the Nasdaq is essentially back where it was at this time last year -- a year when the index rose 85 percent. The Dow, meanwhile first crossed its current levels in April, 1999.

Those performances come in sharp contrast to the 90s, which saw only one year when the major indexes fell: 1990. Those performances come in sharp contrast to the 90s, which saw only one year when the major indexes fell: 1990.

Al Goldman, chief market strategist for A.G. Edwards, told CNNfn's market coverage that the recent sell-off should be seen by investors as a buying opportunity. (310K WAV) (310 AIFF).

The earnings warnings continued Wednesday. Nordstrom (JWN: Research, Estimates) fell $1.06 cents to $14.63 after the retailer said Wednesday that it could report a loss for the third quarter due to non-recurring charges and lower-than-anticipated sales.

Click here for a look at CNNfn's earnings calendar

Some analysts hope the flood of actual earnings results for the July-September period in the days ahead could lift stocks.

"When all is said and done, the fact of the matter is we will have double-digit earnings growth for the S&P 500," said Elizabeth Mackay, chief investment strategist at Bear Stearns.

In the session's most closely watched profit report, General Electric (GE: Research, Estimates), the nation's biggest company in terms of market value, said third-quarter earnings rose 20 percent to 32 cents a share, matching Wall Street forecasts. GE, a Dow component known for beating estimates, lost $1.50 to $56.56.

Crude oil prices rose again Wednesday, a worrisome development that could eat into corporate profitability and slow consumer spending.

Oil stocks, one of the year's best-performing sectors, gained with the price of the commodity. Exxon Mobil (XOM: Research, Estimates) rose 31 cents to $93.63. Consumer products makers also advanced, with Procter & Gamble (PG: Research, Estimates) gaining 88 cents to $73.31.

|

|

|

|

|

|

|