|

Fresh start for Wall St.?

|

|

April 2, 2001: 7:53 a.m. ET

Investors hope that new quarter will bring better news, stock performance

|

NEW YORK (CNNfn) - Investors start the new quarter Monday hoping that it's better than the last one, as they brace themselves for the latest reports on the sluggish U.S. economy.

Futures prices suggest U.S. stocks may be poised to start a bit higher. Nasdaq-100 futures and Standard & Poors futures both edged higher, taking fair value into account, suggesting a slightly higher start for the Nasdaq, the S&P 500 and the Dow Jones industrial average.

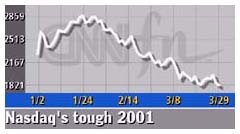

All three indexes closed higher Friday, although all are much lower than where they began the first quarter. The Nasdaq composite gained 1.1 percent to 1,840.26 Friday, while the Dow climbed 79 points to 9,878.78. The S&P 500 also rose about 1 percent to 1,160.33. All three indexes closed higher Friday, although all are much lower than where they began the first quarter. The Nasdaq composite gained 1.1 percent to 1,840.26 Friday, while the Dow climbed 79 points to 9,878.78. The S&P 500 also rose about 1 percent to 1,160.33.

Overseas indexes were generally lower early Monday. Asian markets closed lower, as Hong Kong's Hang Seng index became the worst performing stock benchmark in the region this year. Europe's major markets were mostly lower, led by Germany's financial sector after Allianz agreed to buy Dresdner Bank for $21 billion.

Treasury bonds were little changed in early trading Monday, with the 10-year yield at 4.92 percent and the 30-year at 5.45 percent.

The dollar also rose against the yen, hitting another new 22-month high, and edged up versus the euro. Brent oil futures rose 13 cents to $25.05 a barrel in London.

A big part of the U.S. market's woes can be traced to worries about the economy. Manufacturing has been particularly hard hit and Monday brings two new measures of the state of that sector.

The National Association of Purchasing Management's index of manufacturing activity is due after the market opens, with economists surveyed by Briefing.com forecasting a reading of 42.5 for March. While that's up from the 41.9 reading in February, anything below 50 points to contraction in the manufacturing sector. The National Association of Purchasing Management's index of manufacturing activity is due after the market opens, with economists surveyed by Briefing.com forecasting a reading of 42.5 for March. While that's up from the 41.9 reading in February, anything below 50 points to contraction in the manufacturing sector.

Auto sales for March are due Monday afternoon. Sales are expected to come in well off year-ago levels. February construction spending information is also due.

In company news, the $7 billion merger between FPL Group Inc. and Entergy Corp. was called off Monday, two weeks after the two utilities announced the deal had run into trouble. The merger would have created the nation's largest power producer. Shares of FPL (FPL: Research, Estimates) gained 10 cents to $61.30 Friday, while Entergy (ETR: Research, Estimates) shares rose 83 cents to $38.

Electronic Data Systems said it plans to buy German rival Systematics for about $570 million in cash and stock. EDS (EDS: Research, Estimates) shares closed up 2.9 percent in New York Friday at $55.86.

The Wall Street Journal reported Monday that the board of Donna Karan (DK: Research, Estimates) approved an increased offer from France's LVMH that values the fashion house at $242 million. Shares of Donna Karan gained 3 cents to $8.98 in trading Friday.

Investors will also be looking for news out of the Comdex technology trade show and conference that kicks off in Chicago Monday.

|

|

|

|

|

|

|