|

Will the Fed lifeline last?

|

|

January 4, 2001: 3:36 p.m. ET

Greenspan & Co. have thrown a lifeline to the economy. Will the rope hold?

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - It didn't take a Ph.D. in economics to figure out that things were looking pretty grim for the U.S. economy at the end of 2000. The stock market was down for the count. Pink slips seemed to be piling up. People weren't buying. And the bond market was predicting recession.

And then along came Alan.

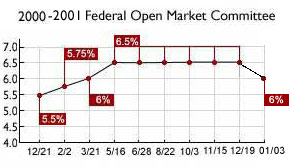

In Superman-like fashion, the chairman of the Federal Reserve stunned the world by swooping in and rescuing the economy and the stock market from peril, unexpectedly lowering short-term interest rates by a half point. It was the first half-point rate cut by the Fed since the credit-crunch crisis of 1998 and the third inter-meeting rate move in more than eight years.

And, the markets loved it: a record 14 percent gain for the Nasdaq composite index; a 5 percent gain for the S&P 500; and a near 3 percent gain for the Dow Jones industrial average. Not bad for 2 hours and 45 minutes of trading. Consumers won't be so shy to spend, they reasoned. Companies can borrow more for less. Corporate profits won't be so bad. And, the markets loved it: a record 14 percent gain for the Nasdaq composite index; a 5 percent gain for the S&P 500; and a near 3 percent gain for the Dow Jones industrial average. Not bad for 2 hours and 45 minutes of trading. Consumers won't be so shy to spend, they reasoned. Companies can borrow more for less. Corporate profits won't be so bad.

So the euphoria went. With the one-day party over, the question remains: what is it going to take to ensure that the record economic expansion doesn't fall off the wagon and hit the pavement? How many more times will Fed Chairman Alan Greenspan and his policy-setting colleagues have to lower rates to restore now-shattered consumer and business confidence?

"I think the Fed recognized that confidence was really beginning to get away from them," said Steve Slifer, chief economist with Lehman Brothers. "The important message is that these guys are trying to tell the markets that they are going to make absolutely sure that the economy does not slide into recession. In some ways they took the 'R' word right out of the dictionary, but it is equally clear that their work is far from over."

A stumbling economy

It was no secret that the U.S. economy was stumbling badly leading up to Wednesday's move. On the consumer side, retail sales were abysmal in November and December, purchases of big-ticket items such home appliances and electronics were on the decline. New home sales had tapered off and auto sales were downright ugly. And consumer confidence had fallen off the precipice.

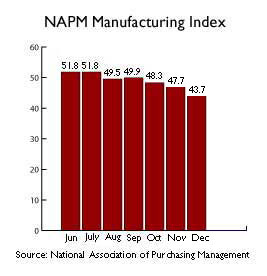

On the business side, things looked equally bad. The National Association of Purchasing Management's December survey showed manufacturing was in a five-month slump, with output levels at their worst since the 1991 recession. And other factors -- including falling orders for durable goods, declining output at the nation's factories, and rising inventories on warehouse shelves -- all painted a grim picture of stuff that suddenly nobody seemed to want to buy.

It all pointed to what the Fed had meticulously tried to accomplish in the first place: curbing borrowing. When rates rested at 4.75 percent back in early 1999, it wasn't such a big deal for consumers to take out new loan or rack up a few bucks on the old credit card. And for businesses, spending money on new forms of technology and infrastructure was no biggy either; whether it was through the bank or the credit markets, there was always ample cash around to borrow. It all pointed to what the Fed had meticulously tried to accomplish in the first place: curbing borrowing. When rates rested at 4.75 percent back in early 1999, it wasn't such a big deal for consumers to take out new loan or rack up a few bucks on the old credit card. And for businesses, spending money on new forms of technology and infrastructure was no biggy either; whether it was through the bank or the credit markets, there was always ample cash around to borrow.

But as the Fed kept pulling in the reins, things got more and more difficult. For consumers, rising interest rates, rising oil and gasoline prices and falling stock market values all had the unmistakable impact of damping sentiment. For businesses, it was much the same thing, with the added one-two punch of not having as many lenders willing and able to step up to the plate.

"Things obviously got away from them," said David Orr, chief economist with First Union Securities. "But by acting in such dramatic fashion, the Fed sent a loud signal to participants in both the financial and the business sectors that the Fed will fight the threat of recession as vigorously as it fought the threat of inflation."

The recession-fighting sword

Now, the Fed's sword has suddenly and swiftly been put to a different task -- lashing at recession, rather than inflation. But will brandishing the sword once in the form of a swift, half-point cut be enough to put the economy on track for a "soft landing" from the recent 6 percent pace of growth in 2000 to what economists are now predicting should be 3 percent growth in 2001?

In a word, no.

For starters, investors aren't going to be willing to dive back into the murky waters of the stock market anytime soon. Anecdotally, almost everyone with a stock portfolio has seen the value of their holdings fall significantly in the past year to a level that has made them nervous about buying more.

And a half-point cut in rates isn't going to get companies to suddenly open up their checkbooks and begin dolling out cash for new equipment and infrastructure -- at least not right away. "You aren't going to see telecom companies suddenly reverse their cancelled orders for telecommunications and fiber-optic equipment, " said Tom Lauria, an analyst with ING Barings. "They will likely continue to be cautious about their spending intentions."

What's more, there is still bad news on the way. On the economic front, the effects of the Fed's previous six rate increases will still show their might, starting with Friday's employment numbers. Analysts polled by Briefing.com anticipate that the U.S. economy added 133,000 new positions last month, and that the jobless rate edged up to 4.1 percent from 4 percent. What's more, there is still bad news on the way. On the economic front, the effects of the Fed's previous six rate increases will still show their might, starting with Friday's employment numbers. Analysts polled by Briefing.com anticipate that the U.S. economy added 133,000 new positions last month, and that the jobless rate edged up to 4.1 percent from 4 percent.

And on the corporate front, companies will begin unveiling their fourth-quarter profits -- and losses -- next week. According to First Call, the 500 companies that comprise the S&P are expected to post earnings 4.3 percent higher than they did a year ago, well below the 21.3 percent year-over-year earnings growth they showed in the final quarter of 1999.

"If we are right that both the pace of economic activity and corporate earnings are still fraught with near-term, downside risk, equity values and risk spreads will carry a recession uncertainty premium for some time -- a premium that the Fed will still want to counter," said Richard Berner, chief economist with Morgan Stanley Dean Witter.

More cuts to come

Indeed, according to a poll conducted by Reuters in the wake of Wednesday's easing, 21 out of 24 primary Wall Street dealers now expect the Fed to cut rates by a further quarter point at its Jan. 30-31 policy meeting, and one firm expects another half-point move by then. Two dealers said they expect the Fed to hold pat at their end-of-month meeting.

And 19 of the 24 primary dealers who provided forecasts said they saw the federal funds rate falling to 5.5 percent or lower by the end of June, compared to only three of 26 primary dealers surveyed in the last poll conducted by Reuters in mid-December.

| |

|

|

| |

|

|

| |

This is a normal, cyclical slowdown in growth, engineered by the Fed. That's what the Fed told us they were going to do a year ago. They achieved it and don't want to overdo it.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Bob Goodman, Putnam Investments |

|

What most analysts agree on is that Fed Chairman Greenspan, in usual fashion, is there to save the stock market and the economy's day. While there may be some short-term pain as financial markets digest more bad news, the longer-term view is one of sustained growth with low inflation.

Add to that the expected tax cut from President-elect George W. Bush and most economists see a decent economic outlook emerging in the second half of 2001 -- an outlook that includes a more moderate, 3 percent growth, slightly higher consumer spending and a positive environment for stocks.

Wayne Angel, chief economist with Bear Stearns and a former Fed governor, told CNNfn's Before Hours that he expects to see some rough spots for both the economy and the stock market in the short term, but those rough spots will be very different with the Fed's determination to keep the economy growing. (403KB WAV) (403KB AIFF)

"This is a normal, cyclical slowdown in growth, engineered by the Fed," said Bob Goodman, a senior economic adviser with mutual fund company Putnam Investments. "That's what the Fed told us they were going to do a year ago. They achieved it and don't want to overdo it."

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|