|

The Fed - looking ahead

|

|

December 18, 2000: 4:03 p.m. ET

A growing contingent suddenly think the Fed may lower rates. What will they do?

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Many people blamed poor weather in the Northeast for the glaring lack of crowds along New York City's notorious holiday magnet Fifth Avenue this past weekend. Torrential rains and strong winds did keep many from traversing the famous stretch in search of the perfect holiday gift.

But for economists, analysts, market watchers or any biz buff that happened to be out braving the elements in the Big Apple during the second-to-last shopping weekend before Christmas, the lack of hustle and bustle had less to do with the elements and more to do with the state of the U.S. economy -- an economy that a growing contingent are saying has screeched to a halt. But for economists, analysts, market watchers or any biz buff that happened to be out braving the elements in the Big Apple during the second-to-last shopping weekend before Christmas, the lack of hustle and bustle had less to do with the elements and more to do with the state of the U.S. economy -- an economy that a growing contingent are saying has screeched to a halt.

That is why some, hardly a majority, but some, are suggesting that things have gotten so bad so fast on the economic scene that the Fed may actually ease short-term interest rates Tuesday -- the first easing of official short-term rates since the Russian ruble debacle, the Long Term Capital Management collapse and the subsequent credit crunch crisis of 1998.

"We have been telling our clients for the last two or three weeks we think there will be a rate cut tomorrow," Greg Valliere, a markets strategist with Charles Schwab Washington Research Group, told CNNfn's Before Hours. "I think Greenspan realizes if he doesn't move tomorrow, he may have to do 50 basis points at the end of January, which could look panicky."

Turning on a dime

Indeed, on a dime, what appeared to be an imminent threat of an overheating economy and accelerating inflation has quickly turned into an what some say may be an imminent threat of recession, where consumers and businesses pack away their check books and refuse to spend. The textbook definition of recession is two straight quarters of negative growth.

has nose-dived. According to a Gallup poll conducted earlier this month, almost one in two Americans polled said the economy was getting worse -- the first time that a majority held a more pessimistic than an optimistic view of future economic conditions since July 1996. has nose-dived. According to a Gallup poll conducted earlier this month, almost one in two Americans polled said the economy was getting worse -- the first time that a majority held a more pessimistic than an optimistic view of future economic conditions since July 1996.

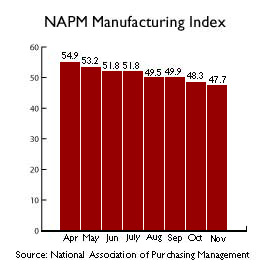

And other factors also point to a notable economic slowdown. Manufacturing output has tapered off. Factory orders have declined. Orders for durable goods have dropped. Inventory levels have risen. Income levels have declined. Retail sales have dropped. And the unemployment rate has ticked up, with fewer new jobs being created in recent months.

Add to that the dismal performance of the stock market this year, which has erased millions in paper gains and all but eradicated the Greenspan-dubbed "wealth effect," and you have the makings of what many on Wall Street and in Washington are calling a ripe recipe for recession. The Dow Jones industrial average is on track for a single-digit percentage loss this year (it is currently off 7.4 percent). The Nasdaq, down 35.5 percent year to date, is poised for its worst year since its inception in 1971.

The risks have changed

"I think the risks have certainly changed from one that was tilted toward inflation to one that is tilted toward recession," said Jeff Cheah, a markets analyst with Standard & Poor's MMS. "We are still expecting to see a soft landing but there's enough evidence to suggest the U.S. economy is indeed slowing, and perhaps more dramatically than people had anticipated."

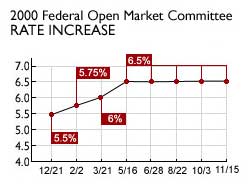

The slowdown in economic growth is in part the Fed's doing to begin with. Between May 1999 and June 2000 the Fed raised rates six times in an effort to slow the economy down and keep inflation in check. Its last rate increase was a hefty half-point hike that came amid an exceptionally strong series of economic reports, including near-record wage gains and job growth.

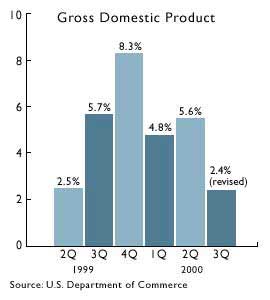

Now some Fed insiders are wondering if they acted too harshly, according to a report in Monday's Wall Street Journal, which suggested that some within the Fed are a tad concerned that the economy is responding too well to their series of rate increases. The economy grew at the slowest rate in four years in the third quarter, while consumer confidence dipped sharply. Now some Fed insiders are wondering if they acted too harshly, according to a report in Monday's Wall Street Journal, which suggested that some within the Fed are a tad concerned that the economy is responding too well to their series of rate increases. The economy grew at the slowest rate in four years in the third quarter, while consumer confidence dipped sharply.

At least some investors are betting the Fed will cut rates tomorrow. The implied yield on the fed funds futures contract that expires at the end of this month declined to 6.46 percent Monday, below the current fed funds target rate of 6.5 percent, suggesting the market is pricing in a slim possibility that the Fed will lower rates tomorrow. The yield on the January contract rests at 6.30 percent and the yield on the March contract sits at 6.08 percent.

And some politicians in Washington are jumping onto the bandwagon, calling on the Fed and its leader to cut interest rates now to ensure the economy doesn't slide into recession. Sen. Byron Dorgan (D-N.D.) implored the Fed Tuesday to cut rates and avoid a recession before it is too late. (247KB WAV) (247KB AIFF)

Animated discussion expected

To be sure, the Fed's job is not to monitor whether consumers are thinking twice about buying that SUV or new home theater system. The job of the Fed's policy-setting arm, the Federal Open Market Committee, is to keep the economy growing at a stable, non-inflationary pace where rising prices cannot and do not threaten to derail the record economic expansion.

A deluge of economic numbers, a wrath of data about the performance of financial markets and an economically stimulating tax-cut plan from president-elect George W. Bush will all be fodder for what is expected to be one of the more animated discussions around the Fed's oak table in a very long time. An announcement from the FOMC is expected at 2:15 p.m. ET.

Most on Wall Street expect only a change in verbiage from the Fed -- an alteration in the wording of their collective one-page post-meeting statement that says they are finished with their fight against inflation and are now looking at an economic picture that is more evenly balanced.

But they have surprised before.

"You've got a recession in the auto and computer industries, you've got inventories piling up, you've got mediocre consumer spending, you've got a terrible stock market," said Schwab's Valliere. "I think the time to cut rates is now and I think they are in a good position to do it. If the Fed shows tomorrow that they realize this economy needs stimulus, I think it would be a wonderful gift for the stock market."

|

|

|

|

|

|

U.S. Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|